Come April 2018, you won’t need to sign on the dotted line when paying with plastic. All four major credit card networks (American Express, Visa, MasterCard and Discover) are dropping requirements that make a credit card signature necessary.

The shift away from signing a receipt has been driven by the rise of digital payment technology and EMV chip credit cards. Mobile and contactless payments have made purchases quick and more convenient for both customer and merchant.

Compare Credit Cards

Credit card signature policy announcements

MasterCard: The first card brand to announce a no-signature policy. In October 2017, MasterCard announced that eliminating the credit card signature is “… another step in the digital evolution of payments and payment security.” The company said more than 80% of in-store transaction processed don’t need a signature — and that number is likely to go up to 100% by April 2018.

Discover Card: In December 2017, Discover Card followed MasterCard and announced they too would be eliminating signatures at checkout, saying “With the rise in new payment security capabilities, like chip technology and tokenization, the time is right to remove this step from the checkout experience.”

American Express: Not far behind Discover’s announcement was American Express who stated, “The move, which applies globally to all American Express-accepting merchants, will help provide a more consistent and simplified checkout experience for merchants and Card Members in regions around the world.”

Visa: The last and largest credit card network, Visa, announced in January that they will make signatures optional and will still require them for any non-EMV card purchases.

At the end of the day, merchants will remain able to collect signatures if required to do so by an applicable law in a particular jurisdiction.

But the natural evolution of digital payments is making the signature an artifact — we simply don’t need it anymore.

Indeed, the industry has been moving away from signatures for some time. The 1990s brought about low-value purchases to make your time in the check-out line faster. But their policies were typically on purchases less than $50.

Credit card signature history and security

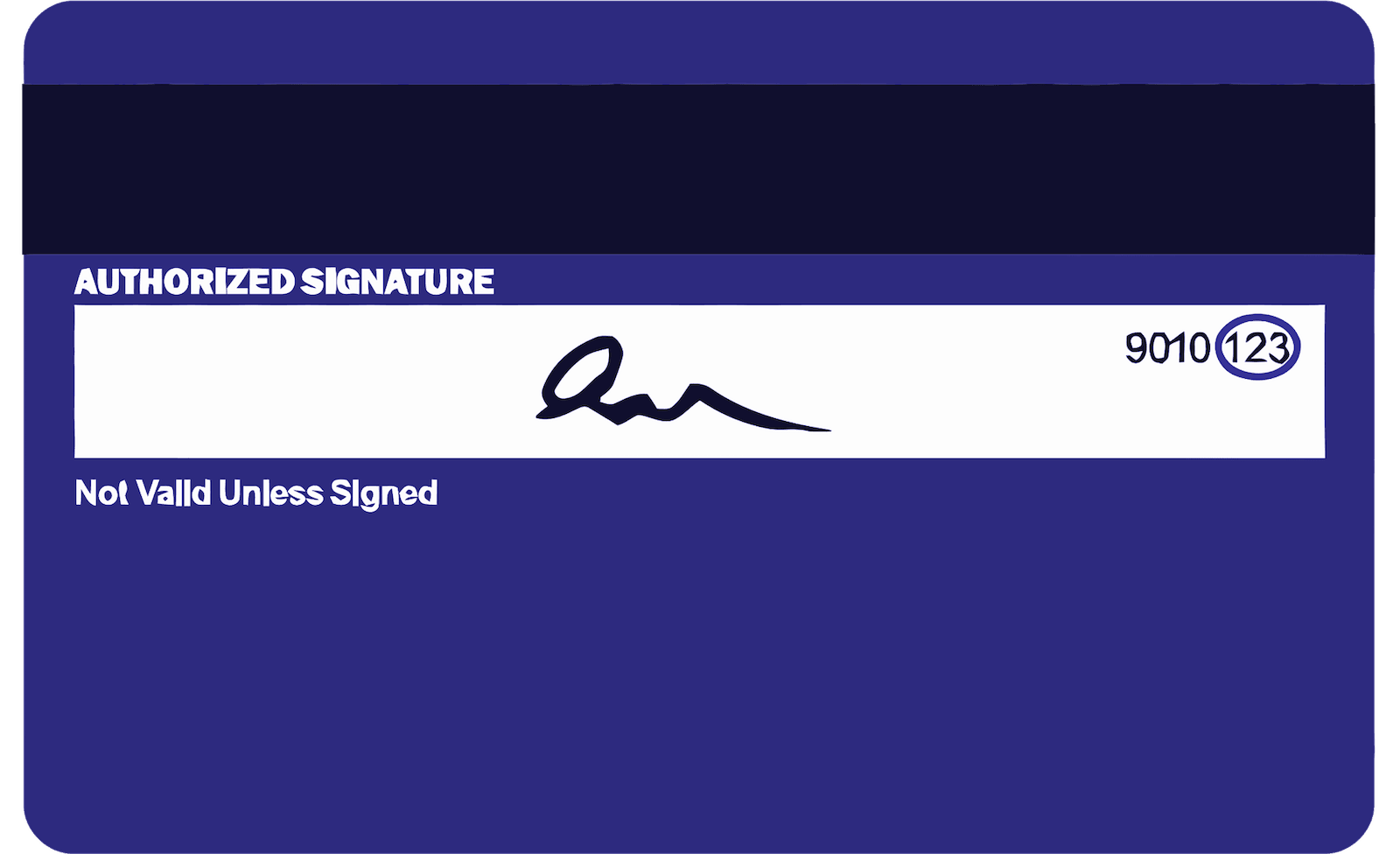

Since credit cards were first introduced, customers have been required to sign the receipt when making a purchase to verify card ownership. The practice was part of the verification process to protect both merchant and customers from fraud. However, with many signatures barely legible and merchants rarely comparing your scribble against the one on the back of the card, your autograph has become an obsolete practice that provides no added security.

“The signature really doesn’t do much to prove whether the person with the card in their hand is the true card holder or not. Doing away with the signature really doesn’t have much impact on security, because it wasn’t providing a whole lot of security in the first place,” says Craig Sherman, vice president of government affairs at the National Retail Federation.

Credit card brands insist that removing the need to sign for purchases will not have any impact on safety. And while many network and payment systems already include other methods to prove a cardholder’s identity, the U.S. is still behind the rest of the world when it comes to credit card security.

A prime example is EMV chip-enabled cards. In 2015, banks and credit card issuers shifted to EMV chip-enabled cards from magnetic strip cards. In theory, they’re supposed to be more secure because unlike a magnetic strip, which holds a static amount of data about the card and account, the chip is “smart” enough to produce a unique code each time it’s used. But what the U.S. is missing is an extra line of defense in the form of a four-digit PIN number. Anyone can forge a signature, but without this unique code, the transaction cannot move forward – making the chip-and-PIN option much more secure.

“A PIN number for credit cards is standard throughout most of the world and has been a requirement at ATM machines in the United States for generations. If you can’t get cash out of an ATM with just a signature, why should you be able to charge hundreds, if not thousands of dollars, on a credit card with just a signature … or now, with nothing at all,” questions Sherman.

Many consumer advocates have backed implementation of chip and PIN credit cards in the U.S. The microchip coupled with the individual PIN make tampering and counterfeiting the cards, along with stealing data, nearly impossible.

Compare Credit Cards