You hear it mentioned all the time. But what exactly is the prime rate? The answer is both simpler and more complex than you think.

What is the prime rate? Let’s take a look:

In the simplest terms, the prime rate, sometimes called the prime lending rate or prime interest rate, is the interest rate that individual banks charge their most creditworthy customers, including large corporations.

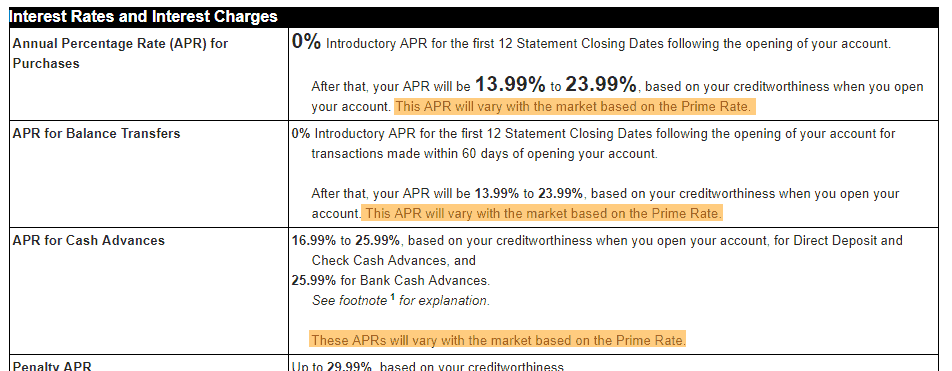

It is often used as a starting point, or “index rate,” for other loans like credit cards, personal loans and small-business loans. For example, you’ve probably seen language in credit card offers like this:

This means that if the prime rate increases by 1%, then the rates described would also increase by 1%. So as the prime lending rate changes, so do the rates all borrowers pay.

Compare Personal Loan Rates

Who sets the prime rate?

While it sounds like something the government would establish, every bank has the latitude to set and adjust its own prime interest rate any time they want. But that’s not to say that government policy doesn’t influence the rates banks charge. The Federal Reserve’s Open Market Committee sets a rate called the federal funds rate. That’s the rate at which banks borrow from one another.

And just about every single bank in the country sets its prime interest rate as the federal funds rate plus 3%.

So a bank borrowing at the federal funds rate of 1.25% will make loans to its best customers at a prime of 4.25%.

What is the current prime rate?

The current prime rate is 4.25%. That’s the average noted by the the Fed, which monitors the prime rates charged by the country’s 25 largest banks and reports on it weekly.

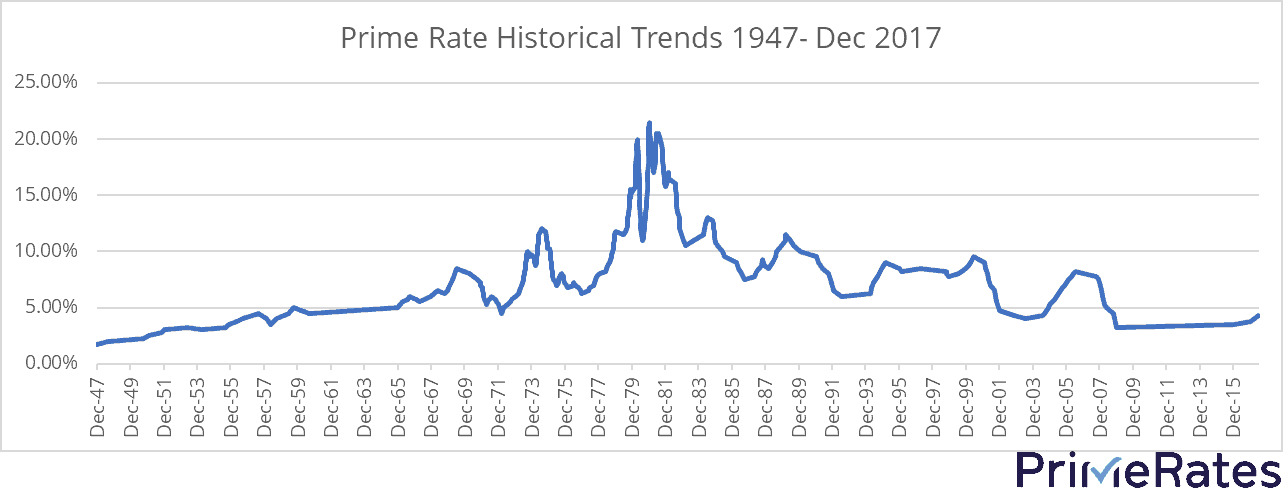

What are the prime rate historical trends?

The prime lending rate has ranged from a low of 1.75% back in 1947 to a high of 21.5% back in December 1980. Starting in December 2008, it remained unchanged at 3.25% for 7 years. That’s the longest period of stability in history.

Is the prime rate going up?

Beginning in December of 2015 and continuing through today, the prime interest rate has risen steadily from 3.25% to 4.25%. It’s a modest increase by historical standards. In September 2017, the Fed indicated that it expects to the federal funds rate to increase by 0.75% during 2018. That means that by the end of 2018, the prime rate could be as high as 7.25%.